How To Optimise Your Customer Lifetime Value

In marketing, customer lifetime value, lifetime customer value or user lifetime value is a prediction of net profit attributed to the entire future relationship with customers.

Almost all of the advice you get these days is on driving marketing results by conversion rate optimisation, so what’s the difference and what would be better for you to focus on?

Firstly, what’s the significance of increasing sustainable profitability and maximising your customer lifetime value?

Dear Business owner,

Let’s be very honest, you’re working harder taking care of business, sales are flat lining and stagnant, its a struggle and sucks even more when your cash flow is hemorrhaging.

This is especially frustrating if you really want to get measurable growth even though your customer base has remained stable…

You’re thinking its tough and not fair right, but why are you focused on the front-end of sales or conversion rate optimisation?

On a daily basis you’re reminded by the media of the slow, bad or indifferent economic shake-up conditions.

So what…why should you care? You want to get the most on your marketing dollars…

Mission impossible, in a competitive market where customer choice is abundant, competing on product or service is unlikely to be a long term viable strategy.

You already know the marketplace is littered with products and acquiring new customers isn’t getting any cheaper or easier, the cost per sale is also rising right?

Look, this is a simple strategy that most businesses aren’t using…

Are you the kind of savvy business owner that wants to get more out of your customers?

Meaning…how do you get to a point in your business where you’re comfortable, willing and able to pay much more to acquire new customers?

Not talking about minimising costs and maximising profit here (more on that later)…

Customer lifetime value optimisation is key to success and the most powerful secret which gives you many profitable strategies with insights into how to grow your business.

Would your business want a customer centric process, which focuses on how you acquire new customers, retain and maximise the value of customer relationships:

- Why knowing your prospect is really crucial

- Know what your customers really want

- Right way to communicate with customers

What if customer lifetime value means focusing on real customer value throughout your entire marketing funnel?

Why would you want to do that?

Because that’s where you not only get an incremental improvement you get massive improvement not simply on the first conversion…

In fact, you get doubling and tripling on your overall profitability.

Yes, no doubt that’s a bold and brazen claim to make:

- Why customer lifetime value is important (especially in context of acquisition)

- How to optimally leverage value based segmentation and customer lifetime value

- How to jump start your own customer lifetime value journey

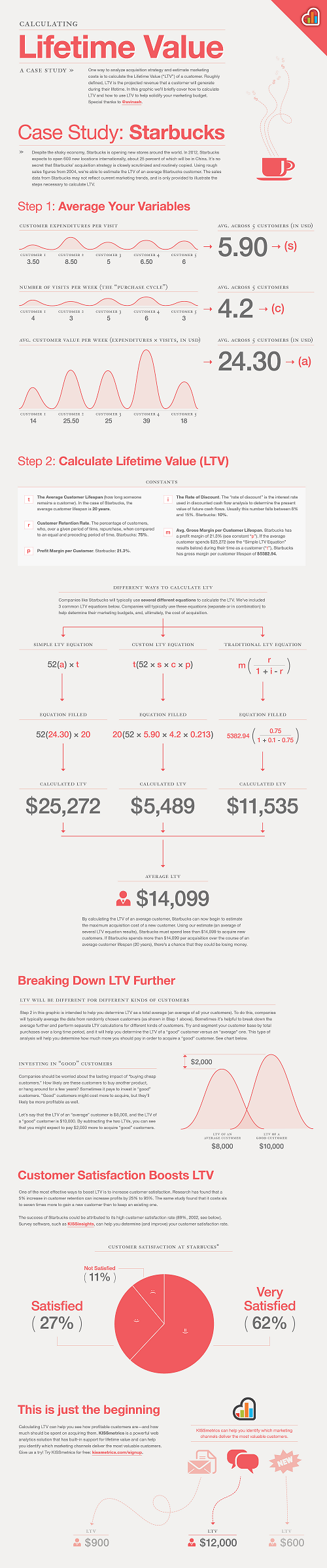

There’s a better way to analyse your acquisition strategy than simply using conversion rates (CR) or cost per acquisition (CPA).

What if you used customer lifetime as a better KPI metric? Customer lifetime value (LTV) empowers you to answer three questions:

- Did you pay enough to acquire customers from each marketing channel

- Did you acquire the ideal or best kind of customers

- How much could you spend on updating with email and social media

Would you ever consider paying significantly more money for the right customers?

Allow me to explain….

How To Solve Your Marketing and Advertising Problems Fast…

Imagine your customer database over the past 2 years, average customer profile represented by these numbers:

- Purchase per year – 3

- Average order value – $80

- Total spend – $240

If you look beyond the averages you’ll find that some of your clients are “better than

average” and some are “worse than average”.

Its always better to segment your customer base by total purchases over a longer time period, for example over a year or total spend.

My most valuable customers last year purchased 5 times compared to an average of 3.

Customers spend 40% more than average per order.

However, these customers might cost you significantly more to acquire.

Much better than the average right?

So, where do you get your high value customers from?

Simply knowing you are getting lots of sales is not enough, you might just be getting new low value customers.

This is where customer lifetime value gets really interesting. You see some companies are getting really worried about the lasting impact of “buying cheap customers”.

For example, in many markets the price comparison intermediary (/engines) is an easy option – you pay your money (affiliate fees) and you take your customer.

How likely are these customers to buy another product or hang around for a few years?

With no brand affinity there’s no desire to cross-buy and maybe we’re filling up our databases with low value, promiscuous customers.

A simple segmentation by channel can easily help us answer these key questions.

What if you can identify channels, campaigns, media or propositions which deliver “better than average” customers?

Well, you can see how much more profitable these buyers are and decide how much more you should be spending to get them.

The result is revealed in the following story…

Amazon.com Approach To Increasing Your Lifetime Customer Value…

There’s a reason why Steve Bezos, CEO of Amazon.com is one of the richest people in the world…so what has Amazon got to do with your business?

Want to know how to use Amazon to easily multiply your sales to make much more money.

Keep reading every word because I’d like to share a short yet powerful story about how Amazon increases your lifetime customer value.

If you’ve ever shopped at Amazon, you’re familiar with the automated review system.

Basically its a tool which is displayed at the bottom of the purchase page, and reveals an upsell with short list of other relevant products customers are buying at point of purchase.

After you add to cart and proceed to buy, you’re presented with another upsell.

So the process is repeated by developing an algorithm to match buyer’s browsing behavior purchase history and entrance source, Amazon can automatically display recommendations based on the buyer’s activity.

While you may or may not be able to develop your own algorithm, it’s still worth segmenting your list to make sure your products are more timely and relevant.

Would you be able to do this in your sales process? For example, you could use the email receipt to offer other products which add value in context to what you have just sold…

If you don’t sell any other products in your upsell via email receipt, why not utilise your thank you page? You could easily offer an affiliate product or premium advertising space to a non-competitor.

Upsells, cross-sells and downsells, these are simple, still very powerful tactics you can use to do deals with other service providers in your industry.

For example: if you’re a kitchen renovator and your core offer is kitchen designs, there are other non-competing companies out there who sell kitchen appliances right?

You could sell them advertising space on your thank you page and vice versa.

You’ve plenty more conversion points to optimise to get more customers engaged, retained, paying more money over time, and sharing your product or service with others.

So when the process after the sale is complete (back-end of your marketing funnel), it doesn’t mean the sale is actually over…

Amazon is doing this really profitably because they’re doing it everywhere they can.

After you buy, you’ll see upsells or cross-sells on the page and via your email receipt, they’re always customer lifetime value optimisation by showing what else you could buy.

It’s crucial to move away from a cost-based acquisition model to one which recognises cross and up-sell rewards of acquiring the right customers over the duration they’ll be your customers.

You want to focus on acquiring truly valuable customers, this is your ticket to continued and long term success…

According to Gartner Group, 80% of your company’s future revenue derives from 20% of your existing customers. Business growth from customer lifetime value (LTV) over time.

Your business could automatically charge customers more on increased engagement and usage of your product, still customers may want to take advantage of higher price plan or more products from you sooner, rather than later.

If you do not do this already, be sure to use calls-to-action for any cross-sell or upsell within your customer experience whenever relevant.

Making these option readily available to take advantage of offers and calls-to-action for better conversion could be one of your biggest opportunities for business growth.

We’ve really only scratched the surface in terms of customer lifetime value optimisation.

Your customer lifetime value optimisation will be a tremendous asset to your business.

Many savvy big-brands have devoted entire resources to unlocking its mysteries. Scary! Yet exciting because finally you can be so much smarter!

Customer Lifetime Value